Mcgraw-hill's Taxation of Business Entities 2019 Edition Spilker Ayers Solutions

By prompting students to engage with key concepts, while continually adapting to their individual needs, Connect activates learning and empowers students to take control resulting in better grades and increased retention rates. Proven online content integrates seamlessly with our adaptive technology, and helps build student confidence outside of the classroom.

Learn more

SmartBook® 2.0

Available within Connect, SmartBook 2.0 is an adaptive learning solution that provides personalized learning to individual student needs, continually adapting to pinpoint knowledge gaps and focus learning on concepts requiring additional study. SmartBook 2.0 fosters more productive learning, taking the guesswork out of what to study, and helps students better prepare for class. With the ReadAnywhere mobile app, students can now read and complete SmartBook 2.0 assignments both online and off-line. For instructors, SmartBook 2.0 provides more granular control over assignments with content selection now available at the concept level. SmartBook 2.0 also includes advanced reporting features that enable instructors to track student progress with actionable insights that guide teaching strategies and advanced instruction, for a more dynamic class experience.

Learn more

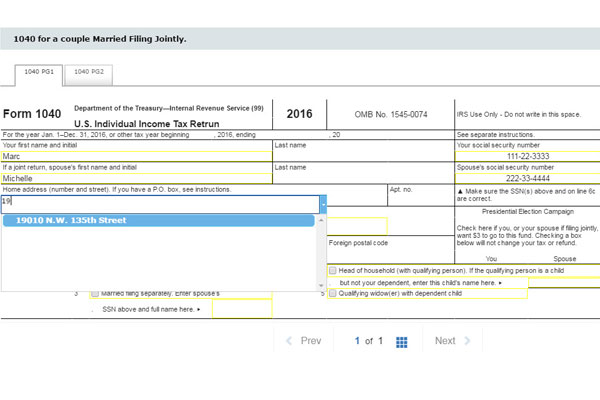

NEW 2018 FORMS!

Auto-graded Tax Return Problems Templated tax forms allow students to apply concepts and gain a better understanding of how tax forms are prepared in today's digital world. These forms include automatic feedback and grading.

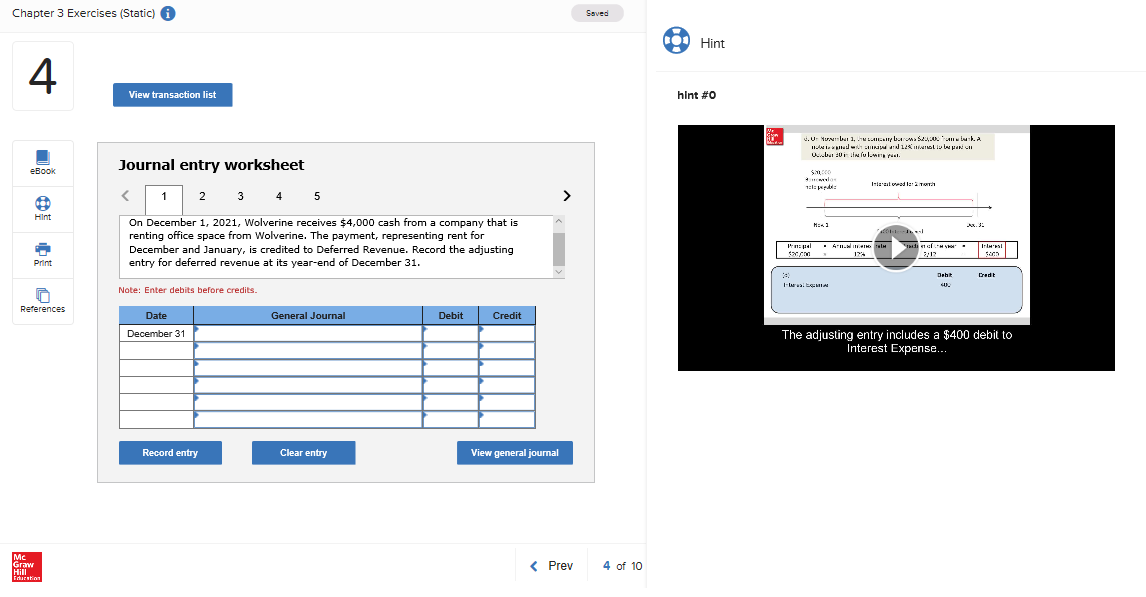

Guided Example hint videos

provide an animated walk-through with narration of select exercises similar to those assigned. These short presentations, which can be turned on or off by instructors, provide reinforcement when students need it most.

TaxAct

is an integrated tax software package from one of the leading tax preparation software companies in the market today. Students are instructed in the practical applications of tax software with exercises that teaches how to prepare both individual and business tax returns.

NEW! Roger CPA

Review exam prep material, featuring multiple-choice questions that are auto-graded in Connect and free student access to CPA Exam Review simulations.

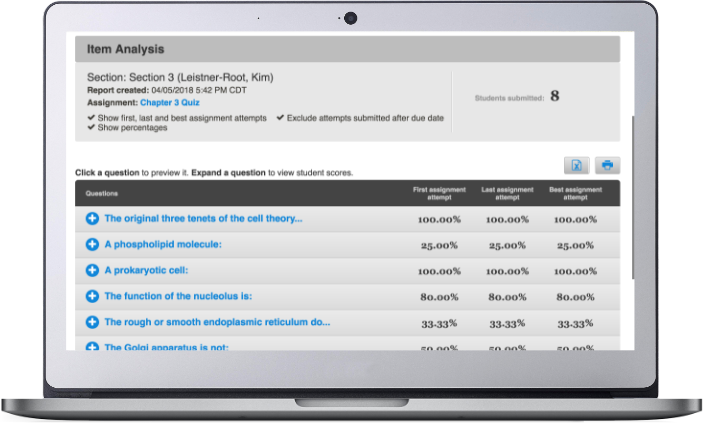

Connect Reporting

View complete, at-a-glance reports for individual students or the whole class. Generate powerful data related to student performance across learning outcomes, specific topics, level of difficulty and more. Additionally, you can compare student performance in different sections of the course.

Learn more

LMS Integration

With a single point of access, Connect seamlessly integrates with every learning management system on the market today. Quickly access registration, attendance, assignments, grades, and course resources in real time in one, familiar location.

Learn more

Service & Support

We provide self-directed resources, on campus training, or webinar sessions, to get you up and running in a way that works for you, and to help you get the most out of Connect. Our technical support team is available to both instructors and students online, via phone or chat whenever you need support.

Learn more

Accessibility Rubric

Creating accessible products is a priority for McGraw-Hill. We have put in place processes to make accessibility and meeting the WCAG AA guidelines part of our day-to-day development efforts and product roadmaps.

Please review our accessibility information for this specific product.

In future editions, this rubric will be reformatted to increase accessibility and usability.

McGraw-Hill sites may contain links to websites owned and operated by third parties. These links are provided as supplementary materials, and for learners' information and convenience only. McGraw-Hill has no control over and is not responsible for the content or accessibility of any linked website.

For further information on McGraw‐Hill and Accessibility, please visit our accessibility page or contact us at accessibility@mheducation.com

Mcgraw-hill's Taxation of Business Entities 2019 Edition Spilker Ayers Solutions

Source: https://www.mheducation.com/highered/product/mcgraw-hill-s-taxation-business-entities-2020-edition-spilker-ayers/M9781260433111.html

0 Response to "Mcgraw-hill's Taxation of Business Entities 2019 Edition Spilker Ayers Solutions"

Post a Comment