What to Claim on W4 With Two Jobs

On-demand coaching with a certified financial planner

Talk to an expert any time, any identify with unlimited chat and video sessions on NerdWallet Plus.

Most people cross paths with a West-iv grade, only not everybody realizes how much power Form Due west-iv has over their taxation bill. Here'due south what the class is used for, how to fill it out and how it can make your tax life improve.

What is a Form W-4?

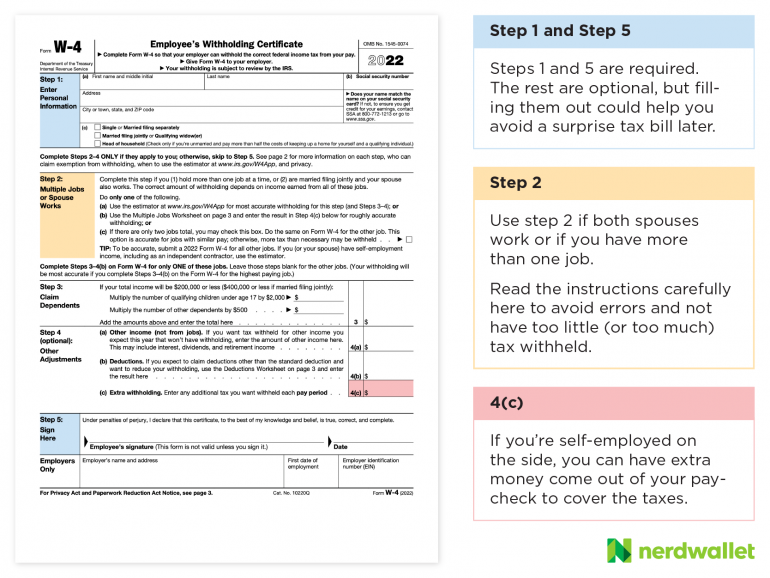

A Westward-4 form, formally titled "Employee'due south Withholding Certificate," is an IRS class employees apply to tell employers how much tax to withhold from each paycheck. Employers utilize the W-4 to calculate certain payroll taxes and remit the taxes to the IRS and the state on behalf of employees.

You practice not have to make full out the new W-four form if you already have one on file with your employer. You likewise don't have to make full out a new W-4 every year. If you starting time a new job or want to arrange your withholdings at your existing job, though, y'all'll likely demand to make full out the new W-4. Either way, information technology'southward a great excuse to review your withholdings.

The West-iv form has changed

In the past, employees could claim allowances on their W-four to lower the amount of federal income tax withheld from their wages. The more withholding allowances an employee claimed, the less their employer would withhold from their paychecks. Even so, the 2017 Tax Cuts and Jobs Act overhauled a lot of tax rules, including doing away with personal exemptions. That prompted the IRS to alter the W-four form.

The new W-4, introduced in 2020, still asks for basic personal information merely no longer asks for a number of allowances. Now, employees who want to lower their tax withholding must claim dependents or utilize a deductions worksheet.

How to fill out a West-4 grade

Form W-4 is available on the IRS website . Here'due south how to complete the steps that employ to your situation.

Stride ane: Personal data

Enter your name, address, Social Security number and tax-filing status.

Step two: Account for multiple jobs

If y'all accept more than 1 job, or you lot file jointly and your spouse works, follow the instructions to get more authentic withholding.

-

For the highest paying job's W-4, fill out steps 2 to 4(b) of the W-4. Leave those steps bare on the W-4s for the other jobs.

-

If you're married and filing jointly, and you lot both earn most the aforementioned corporeality, you can cheque a box indicating as much. The trick: Both spouses need to do that on each of their W-4s.

-

If you don't want to reveal to your employer that you lot have a 2nd job, or that y'all get income from other non-task sources, you have a few options: On line 4(c), yous can instruct your employer to withhold an extra amount of tax from your paycheck. Alternatively, don't factor the extra income into your Westward-four. Instead of having the tax come straight out of your paycheck, transport estimated quarterly tax payments to the IRS yourself instead.

Step iii: Claim dependents, including children

If your total income is nether $200,000 (or $400,000 if filing jointly), you can enter how many kids and dependents you have and multiply them by the credit amount. (See the rules about the child taxation credit and for when you can claim a tax dependent. )

Step 4: Refine your withholdings

If you desire actress taxation withheld or look to claim deductions other than the standard deduction when you exercise your taxes, you lot tin can annotation that.

Step 5 : Sign and date your W-4

Once completed, requite the signed form to your employer'due south homo resources or payroll squad.

Folio 1 Form W-4 (2022)

| |

Promotion: NerdWallet users get 25% off federal and state filing costs. |

| |

Promotion: NerdWallet users tin salve up to $15 on TurboTax. |

| |

|

What should I put on my Westward-4?

If you got a huge tax bill when you filed your tax render final year and don't want another, you can employ Grade West-4 to increment your withholding. That'll assist you owe less (or zero) next time y'all file. If you got a huge refund last yr, you lot're giving the government a free loan and could be needlessly living on less of your paycheck all year. Consider using Form W-iv to reduce your withholding.

Here are some steps you might take toward a specific outcome:

How to have more taxes taken out of your paycheck

If you lot want more taxes taken out of your paychecks, perhaps leading to a tax refund when you file your annual return, here's how you might adjust your West-4.

-

Reduce the number of dependents.

-

Add an extra amount to withhold on line 4(c).

How to have less tax taken out of your paycheck

If y'all want less in taxes taken out of your paychecks, perhaps leading to having to pay a revenue enhancement bill when y'all file your almanac return, hither's how y'all might accommodate your W-4.

-

Increase the number of dependents.

-

Reduce the number on line 4(a) or four(c).

-

Increase the number on line iv(b).

How to use a W-4 to owe zip on a revenue enhancement return

If your objective is to engineer your paycheck withholdings so that you finish up with a $0 revenue enhancement bill when you file your annual render, then the accurateness of your W-four is crucial.

-

Utilize the correct taxation-filing condition. If you file as head of household and haven't updated your Due west-iv for a few years, for example, you may want to consider filling out a new Due west-4 if you want the amount of taxes withheld from your pay to more accurately align with your tax liability. ( Here's how to choose the right filing status. )

-

Make certain your W-4 reflects your current family unit situation. If y'all had a infant or had a teenager turn xviii this year, your tax situation is irresolute and y'all may want to update your West-4.

-

Accurately estimate your other sources of income. Capital gains, involvement on investments, rental properties and freelancing are just some of the many other sources of non-task income that might be taxable and worth updating on line 4(a) of your Westward-iv.

-

Accurately judge your deductions. The W-four assumes you're taking the standard deduction when you file your tax render. If you plan to catalog (presumably because itemizing will cut your taxes more than the standard deduction will), you'll want to estimate those actress deductions and change what'southward on line 4(b).

-

Take advantage of the line for extra withholding. If yous want to accept a specific number of extra dollars withheld from each check for taxes, you tin can put that on line four(c).

Need more aid? At that place are worksheets in the Form W-4 instructions to assistance you lot estimate certain tax deductions you might have coming. The IRS' West-4 calculator or NerdWallet's tax calculator tin too help.

Three things to keep in mind when filling out Form W-four

1. Notation if you are exempt from withholding taxes.

Beingness exempt means your employer won't withhold federal income taxation from your pay. (Social Security and Medicare taxes volition however come out of your bank check, though.) Generally, the only manner you tin exist exempt from withholding is if 2 things are truthful:

-

You got a refund of all your federal income tax withheld last year because yous had no taxation liability, and

-

You expect the same affair to happen this year.

If you are exempt from withholding, write "exempt" in the infinite below footstep four(c). You still demand to complete steps 1 and five. Also, you'll demand to submit a new W-4 every twelvemonth if you plan to keep claiming exemption from withholding .

2. File a new Due west-4 course when life changes.

Y'all can change your W-iv at whatsoever time, only if whatsoever of these things happen to you during the year you might especially want to update your W-4 and then your withholdings reverberate your tax life:

-

You get married or divorced.

-

You lot take a pay cut or go a big raise.

-

You work merely office of the year.

3. Get comfortable fiddling with your withholdings.

Tinkering is OK. You lot're allowed to give your employer a new Westward-4 at any time. That means yous can fill out a W-four, requite it to your employer so review your next paycheck to see how much money was withheld. Then yous can commencement estimating how much you'll have taken out of your paychecks for the full year. If it doesn't seem like it'll be plenty to cover your whole tax bill, or if information technology seems like information technology'll end up being way also much, you lot can submit another W-iv and arrange.

If you want an extra ready amount withheld from each paycheck to cover taxes on freelance income or other income, yous tin can enter it on lines four(a) and 4(c) of Course W-4.

W-4 calculator

Source: https://www.nerdwallet.com/article/taxes/how-to-fill-out-form-w4-guide

0 Response to "What to Claim on W4 With Two Jobs"

Post a Comment